How to Improve Your Personal Finances: Practical Advice for Long-Term Financial Health

Improving your personal finances is not about getting rich quickly or mastering complex investment strategies. For most people, it is about learning how to manage money better, making informed decisions, and building habits that create stability over time. Regardless of your income level, understanding and improving your personal finances can reduce stress, increase security, and give you more control over your future.

This guide is designed for people who want to improve their personal finances step by step, even if they feel they are starting from zero. The focus is on practical actions, realistic changes, and habits that actually work in everyday life.

Understanding Personal Finances

Personal finances refer to how you earn, spend, save, and manage your money as an individual or household. This includes your income, expenses, savings, debts, and financial goals. When these elements are balanced and organized, your financial life becomes more predictable and manageable.

Many people struggle with personal finances not because they lack intelligence or discipline, but because they were never taught how money works. Schools often do not cover basic financial education, leaving people to learn through trial and error. Improving your personal finances begins with understanding that money management is a skill, and like any skill, it can be learned and improved.

Understanding the personal finance basics is essential for making better decisions about money, including saving, spending, and long-term planning. According to Investopedia, personal finance covers all aspects of managing individual or household finances.

https://www.investopedia.com/personal-finance-4427760

Why Improving Personal Finances Matters

Poor personal financial management can lead to constant stress, debt accumulation, and limited opportunities. On the other hand, healthy personal finances allow you to handle emergencies, plan for the future, and make choices based on preference rather than necessity.

Some key benefits of improving your personal finances include:

- Reduced financial stress and anxiety

- Better control over your spending

- Increased savings and financial security

- Greater freedom to make life decisions

- Improved long-term stability

Financial improvement is not only about numbers; it directly impacts your quality of life.

Step 1: Know Your Financial Reality

The first and most important step to improving your personal finances is understanding where you currently stand. Many people avoid looking closely at their finances because it feels uncomfortable, but clarity is essential.

Start by identifying:

- Your total monthly income (salary, freelance work, side income)

- Your fixed expenses (rent, utilities, transportation, subscriptions)

- Your variable expenses (food, entertainment, shopping)

- Your debts (credit cards, loans, outstanding balances)

Writing everything down often reveals spending patterns you were not aware of. Small, frequent expenses can add up to significant amounts over time. This awareness alone can lead to immediate improvements in your personal finances.

Step 2: Create a Simple and Realistic Budget

A budget is one of the most powerful tools for improving personal finances, yet many people resist it because they associate it with restriction. In reality, a budget is simply a plan for how you will use your money.

A good budget should:

- Reflect your real income and expenses

- Be simple enough to maintain

- Include savings as a priority

- Leave room for flexibility

You do not need a complex system. Even a basic monthly budget that outlines spending limits for key categories can dramatically improve your financial control. The goal is consistency, not perfection.

One of the most effective ways to improve your finances is learning how to create a personal budget that reflects your real income and expenses. The Consumer Financial Protection Bureau provides practical tools to get started.

https://www.consumerfinance.gov/complaint/

Step 3: Build the Habit of Saving

Saving money is essential for healthy personal finances, but it does not require large amounts. What matters most is developing the habit.

Many people wait until they have “extra money” to save, but this approach rarely works. Instead, savings should be treated as a non-negotiable part of your budget.

Helpful saving strategies include:

- Starting with a small percentage of income

- Automating savings transfers

- Saving before spending, not after

- Increasing savings gradually as income grows

Even modest savings create a sense of progress and provide a safety net for unexpected expenses.

Step 4: Create an Emergency Fund

An emergency fund is money set aside specifically for unexpected events such as medical expenses, car repairs, or job loss. It is one of the most important foundations of strong personal finances.

Without an emergency fund, people often rely on credit cards or loans, which can lead to long-term debt. Ideally, an emergency fund should cover three to six months of basic expenses, but starting small is perfectly acceptable.

The key is to keep this money:

- Easily accessible

- Separate from daily spending

- Reserved only for true emergencies

Building an emergency fund takes time, but it significantly improves financial stability.

Financial experts recommend building an emergency fund to handle unexpected expenses. These emergency fund guidelines explain how much to save and how to build it step by step.

https://www.nerdwallet.com/

Step 5: Manage and Reduce Debt

Debt is one of the biggest obstacles to improving personal finances. While not all debt is harmful, high-interest consumer debt can severely limit financial progress.

To improve your financial situation:

- List all debts with balances and interest rates

- Prioritize paying off high-interest debt first

- Avoid accumulating new unnecessary debt

- Make consistent payments, even if they are small

Reducing debt frees up money each month and improves your financial flexibility. Over time, this creates more room for saving and investing.

Step 6: Control Spending Without Feeling Deprived

Improving personal finances does not mean eliminating all enjoyment from your life. The goal is mindful spending, not extreme restriction.

Effective ways to control spending include:

- Identifying non-essential expenses

- Reducing impulse purchases

- Waiting before making large purchases

- Comparing prices and alternatives

By aligning spending with your priorities, you can still enjoy your money while improving your overall financial health.

Step 7: Set Clear Financial Goals

Financial goals provide direction and motivation. Without goals, it is easy to lose focus or revert to old habits.

Good financial goals should be:

- Specific (clear purpose)

- Measurable (trackable progress)

- Realistic (based on your situation)

- Time-bound (with a deadline)

Examples include saving for an emergency fund, paying off debt, or building long-term savings. Clear goals help guide daily financial decisions.

Step 8: Improve Financial Habits Gradually

Long-term improvement in personal finances comes from habits, not one-time actions. Small, consistent changes are more effective than drastic measures.

Healthy financial habits include:

- Reviewing finances regularly

- Tracking expenses

- Planning purchases

- Avoiding emotional spending

Over time, these habits become automatic and significantly improve your financial stability.

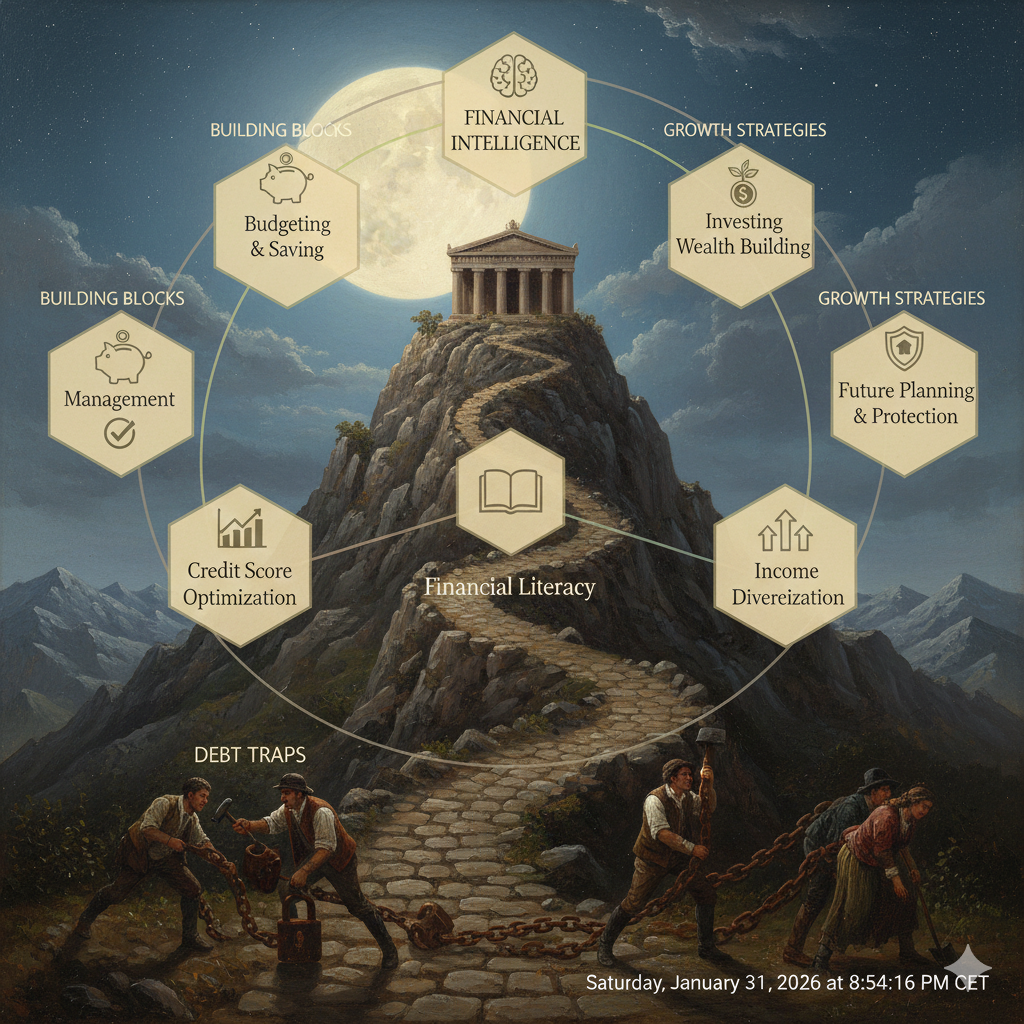

Step 9: Learn Basic Financial Education

You do not need advanced knowledge to improve your personal finances, but understanding basic concepts is essential. Financial education empowers you to make better decisions and avoid common mistakes.

Key topics to learn include:

- Budgeting

- Interest and debt

- Saving strategies

- Financial planning

Free resources, books, and reputable online content can help you build this knowledge over time.

Improving personal finances also requires continuous learning. Reliable financial education resources can help individuals understand budgeting, saving, and responsible money management.

https://www.mymoney.gov/

Step 10: Think Long Term

Improving personal finances is a long-term process. Progress may feel slow at times, but consistency produces results.

Avoid comparing your financial journey to others. Everyone’s situation is different, and sustainable improvement is more important than quick wins. Focus on steady progress, and your financial health will improve over time.

Common Mistakes to Avoid

When working to improve personal finances, it is important to avoid common pitfalls:

- Ignoring small expenses

- Relying on credit for lifestyle spending

- Setting unrealistic goals

- Giving up after setbacks

Mistakes are part of the learning process. What matters is recognizing them and adjusting your approach.

Conclusion

Improving your personal finances is not about perfection or extreme discipline. It is about awareness, planning, and consistent habits. By understanding your financial reality, creating a simple budget, building savings, managing debt, and setting clear goals, you can significantly improve your financial situation over time.

Personal finance is a journey, not a destination. Every small step you take brings you closer to financial stability, confidence, and peace of mind.

Frequently Asked Questions (FAQs)

What does long-term financial health really mean?

Long-term financial health refers to the ability to manage your finances in a sustainable way over time while maintaining stability, flexibility, and peace of mind. It means having control over income and expenses, manageable or no debt, consistent savings, and a clear plan for future goals such as retirement, education, or home ownership. Financial health is not about wealth alone, but about resilience and the ability to handle both expected and unexpected financial events without chronic stress.

What practical steps can improve personal finances over time?

Improving personal finances starts with practical, repeatable actions rather than drastic changes. These steps include tracking expenses, creating a realistic budget, building an emergency fund, reducing high-interest debt, and saving consistently. Over time, these habits compound and lead to stronger financial stability. The key is consistency and making adjustments as income or life circumstances change.

Why is consistency more important than income level?

Consistency matters more than income because financial success is driven by habits, not earnings alone. Individuals with modest incomes but strong financial discipline often achieve better long-term outcomes than high earners who overspend. Regular saving, controlled spending, and intentional planning create financial momentum regardless of income size.

How does debt management support financial health?

Effective debt management reduces financial pressure and frees up cash flow. By prioritizing high-interest debt, avoiding unnecessary borrowing, and maintaining on-time payments, individuals protect their credit health and improve long-term financial flexibility. Proper debt management is a foundational pillar of overall financial wellness.

How long does it take to see real financial improvement?

Meaningful financial improvement is gradual. Small changes can produce noticeable results within months, while long-term financial health typically develops over years. The timeline depends on starting point, income, debt level, and commitment, but steady progress is more important than speed.