How to Organize My Personal Finances with PrimeBail

Learning how to organize personal finances is a fundamental skill for achieving economic stability, reducing stress, and building long-term wealth. Many individuals earn sufficient income but still struggle financially due to lack of structure, planning, or financial education. Organizing personal finances is not about restriction, but about control, clarity, and informed decision-making.

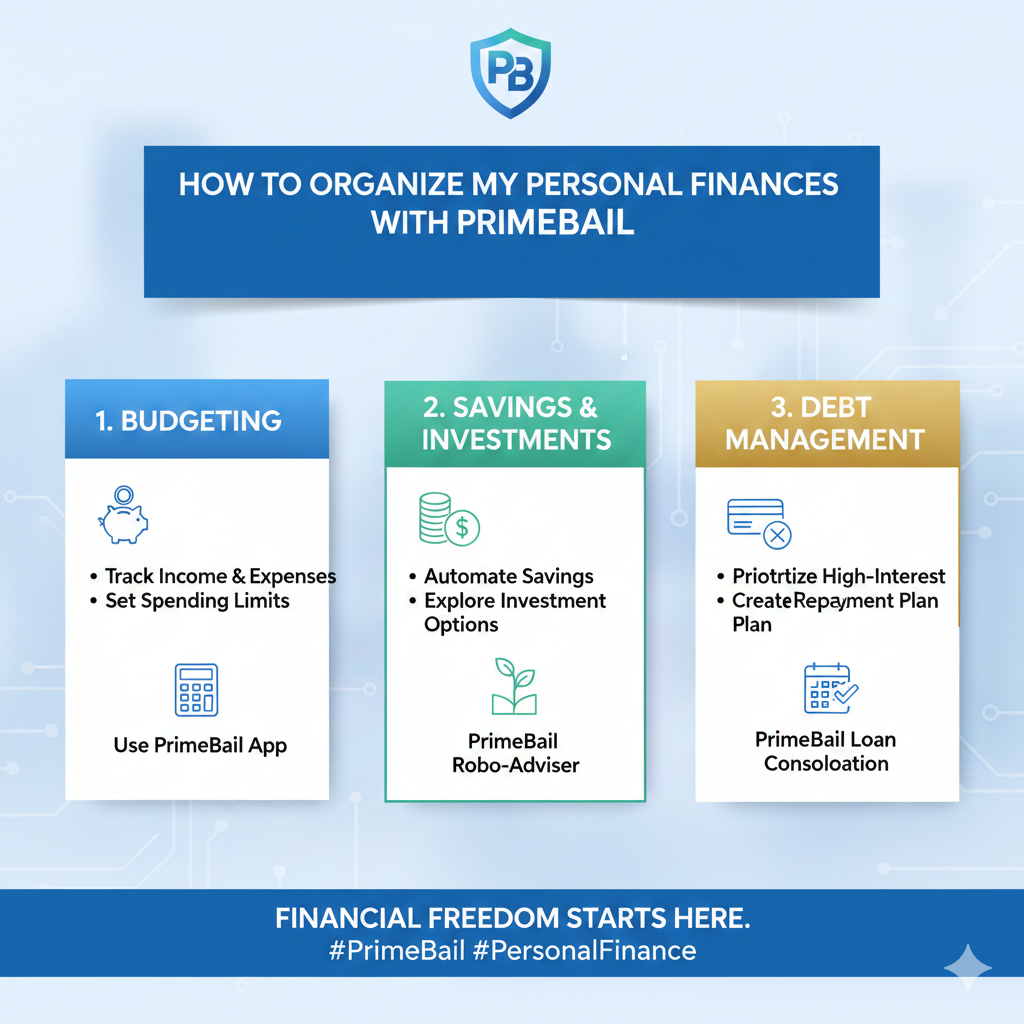

This comprehensive guide explains how to organize personal finances in a structured and methodical way. It covers financial assessment, budgeting, goal setting, debt management, saving strategies, and long-term planning. The objective is to provide a clear framework that can be adapted to different income levels and life situations.

Understanding What Personal Financial Organization Means

Organizing personal finances involves managing money intentionally rather than reactively. It requires knowing where money comes from, where it goes, and how it should be allocated to support current needs and future goals.

At its core, financial organization includes:

- Tracking income and expenses accurately

- Establishing clear financial priorities

- Planning for short-term and long-term goals

- Creating systems to control spending

- Preparing for unexpected events

Without organization, financial decisions are often emotional or impulsive. With organization, money becomes a tool rather than a source of anxiety.

Evaluating Your Current Financial Situation

Before making improvements, it is essential to understand your current financial position. This evaluation provides a realistic starting point and prevents unrealistic planning.

Identifying Income Sources

Income should be categorized clearly to understand financial capacity. This includes:

- Primary income such as salary or wages

- Secondary income such as freelance work or side businesses

- Passive income such as dividends or rental income

All income should be calculated using net figures rather than gross amounts.

Analyzing Expenses and Spending Patterns

Expenses must be tracked over several months to identify patterns. They can be grouped into:

- Fixed expenses such as rent, utilities, insurance

- Variable expenses such as food, transportation, entertainment

- Occasional expenses such as travel or medical costs

This analysis often reveals unnecessary spending and opportunities for optimization.

Defining Clear Financial Goals

Financial goals give direction to financial decisions. Without goals, saving and budgeting lack purpose.

Characteristics of Effective Financial Goals

Well-defined goals should be:

- Specific and clearly stated

- Measurable with concrete amounts

- Realistic based on income

- Relevant to personal priorities

- Time-bound with a deadline

Examples include saving for emergencies, eliminating debt, purchasing property, or preparing for retirement.

Short-Term, Medium-Term, and Long-Term Goals

Short-term goals usually cover periods under one year, such as building an emergency fund. Medium-term goals span several years, such as saving for education. Long-term goals often include retirement or financial independence.

Balancing these timelines ensures both present stability and future security.

Creating a Functional Personal Budget

A budget is the foundation of financial organization. It assigns every unit of income a specific role.

Purpose of a Budget

A budget allows individuals to:

- Control spending intentionally

- Prevent overspending

- Increase savings consistently

- Reduce financial uncertainty

Budgeting is not about deprivation but about prioritization.

Common Budgeting Approaches

Popular approaches include proportional budgeting, where income is divided into needs, savings, and discretionary spending, and zero-based budgeting, where every monetary unit is assigned a task.

The most effective budget is the one that can be maintained consistently.

Managing Debt in a Structured Way

Debt management is a critical component of organizing personal finances. Poorly managed debt limits financial flexibility and increases long-term costs.

Understanding Different Types of Debt

Debt can be categorized based on cost and purpose:

- High-interest consumer debt

- Low-interest structured debt

- Productive debt that supports income or education

Understanding interest rates and repayment terms is essential.

Debt Reduction Strategies

Two widely used strategies are prioritizing high-interest balances or focusing on smaller balances to build momentum. Both require discipline and consistency.

Eliminating high-interest debt often produces immediate financial relief.

Building an Emergency Savings Fund

Unexpected expenses are inevitable. An emergency fund acts as a financial buffer and prevents reliance on debt.

Purpose of an Emergency Fund

An emergency fund covers situations such as job loss, medical expenses, or urgent repairs. It protects long-term financial plans from disruption.

Recommended Size and Storage

A commonly recommended size is several months of essential expenses. Funds should be kept in liquid and low-risk accounts to ensure immediate access.

This fund should only be used for genuine emergencies.

Developing Consistent Saving Habits

Saving is not what remains after spending; it should be a planned allocation of income.

Automating Savings

Automation removes decision fatigue and ensures consistency. Transfers to savings accounts can be scheduled immediately after income is received.

Saving for Specific Objectives

Separating savings by goal increases clarity and motivation. This may include savings for education, travel, or major purchases.

Consistency matters more than the amount saved initially.

Introduction to Long-Term Financial Planning

Long-term planning focuses on preserving and growing wealth over extended periods.

Understanding the Role of Inflation

Inflation reduces purchasing power over time. Long-term financial plans should account for this to preserve real value.

Introduction to Investment Concepts

Investments aim to grow capital through assets such as equities, bonds, or funds. Each carries different levels of risk and potential return.

Education and risk awareness are essential before investing.

Organizing Financial Documents and Systems

Financial organization extends beyond numbers. Documentation and systems are equally important.

Structuring Financial Records

Documents such as bank statements, contracts, tax records, and insurance policies should be categorized and stored securely.

Using Digital Tools

Financial management software, budgeting applications, and spreadsheets can simplify tracking and analysis.

Organization reduces errors and improves decision-making.

Reviewing and Adjusting Your Financial Plan

Financial plans should evolve with life changes. Regular reviews ensure continued relevance.

Frequency of Reviews

Monthly reviews help control budgets, while annual reviews support larger strategic decisions.

Adapting to Life Changes

Changes in income, family status, or economic conditions require adjustments to goals and strategies.

Flexibility strengthens long-term success.

Common Financial Organization Mistakes to Avoid

Even structured plans can fail due to common mistakes.

Lack of Consistency

Inconsistent tracking or budgeting reduces effectiveness.

Unrealistic Expectations

Overly restrictive plans are difficult to sustain.

Ignoring Small Expenses

Small recurring costs often accumulate into significant financial leaks.

Awareness prevents repetition of these errors.

Benefits of Organizing Personal Finances

Effective financial organization offers numerous benefits:

- Reduced financial stress

- Improved decision-making

- Greater savings and wealth accumulation

- Increased financial confidence

Financial organization empowers individuals to align money with values and goals.

Conclusion

Organizing personal finances is a continuous process rather than a one-time action. It requires awareness, discipline, and regular evaluation. By understanding income and expenses, defining goals, budgeting effectively, managing debt, saving consistently, and planning for the future, anyone can build a stable and sustainable financial structure.

The principles outlined in this guide provide a practical framework for those seeking clarity and control over their financial lives. With consistent application, financial organization becomes a habit that supports long-term security and independence.

Frequently Asked Questions (FAQs)

What is the best way to start organizing personal finances from scratch?

The best way to start organizing personal finances is by gaining full visibility over your current financial situation. This means identifying all sources of income, tracking every expense over a defined period, and understanding existing financial obligations such as debts or recurring payments. Starting from scratch does not require complex tools; a simple spreadsheet or budgeting app is often sufficient. Once this information is clear, it becomes easier to prioritize expenses, eliminate unnecessary spending, and create a realistic financial plan. The key is consistency, as financial organization improves gradually through regular monitoring and adjustment rather than immediate perfection.

How can I organize my personal finances if my income is irregular?

Organizing personal finances with irregular income requires a more conservative and flexible approach. The focus should be on calculating an average monthly income based on historical data and budgeting according to the lowest expected income rather than the highest. Fixed expenses should be minimized where possible, and variable expenses should be adjusted based on monthly earnings. Building a larger emergency fund is particularly important in this situation, as it helps smooth income fluctuations. Financial organization in this context relies heavily on adaptability, disciplined saving during high-income periods, and cautious spending during lower-income months.

Is it possible to organize personal finances without cutting all discretionary spending?

Yes, organizing personal finances does not require eliminating all discretionary spending. In fact, a sustainable financial plan should include room for personal enjoyment and lifestyle preferences. The goal is not restriction but intentional allocation of resources. By categorizing discretionary expenses and setting predefined limits, individuals can maintain balance while still progressing toward financial goals. Completely removing discretionary spending often leads to frustration and abandonment of the financial plan. A well-organized financial structure allows for controlled flexibility rather than absolute limitation.

How often should I review and adjust my personal financial plan?

A personal financial plan should be reviewed regularly to remain effective. Monthly reviews are recommended for monitoring expenses, adjusting budgets, and ensuring savings targets are being met. More comprehensive reviews should be conducted annually or after major life changes such as a new job, relocation, or changes in family structure. Regular reviews help identify inefficiencies, adapt to changing circumstances, and reinforce good financial habits. Financial organization is a dynamic process, and periodic adjustments are essential to long-term success.

What are the most common obstacles to maintaining organized personal finances?

The most common obstacles to maintaining organized personal finances include lack of consistency, unrealistic expectations, and insufficient financial education. Many individuals start with strong motivation but fail to sustain tracking and budgeting habits over time. Others create overly restrictive plans that are difficult to maintain. Additionally, ignoring small but recurring expenses can gradually undermine financial organization. Overcoming these obstacles requires realistic planning, continuous learning, and the understanding that financial organization is a long-term habit rather than a short-term project.